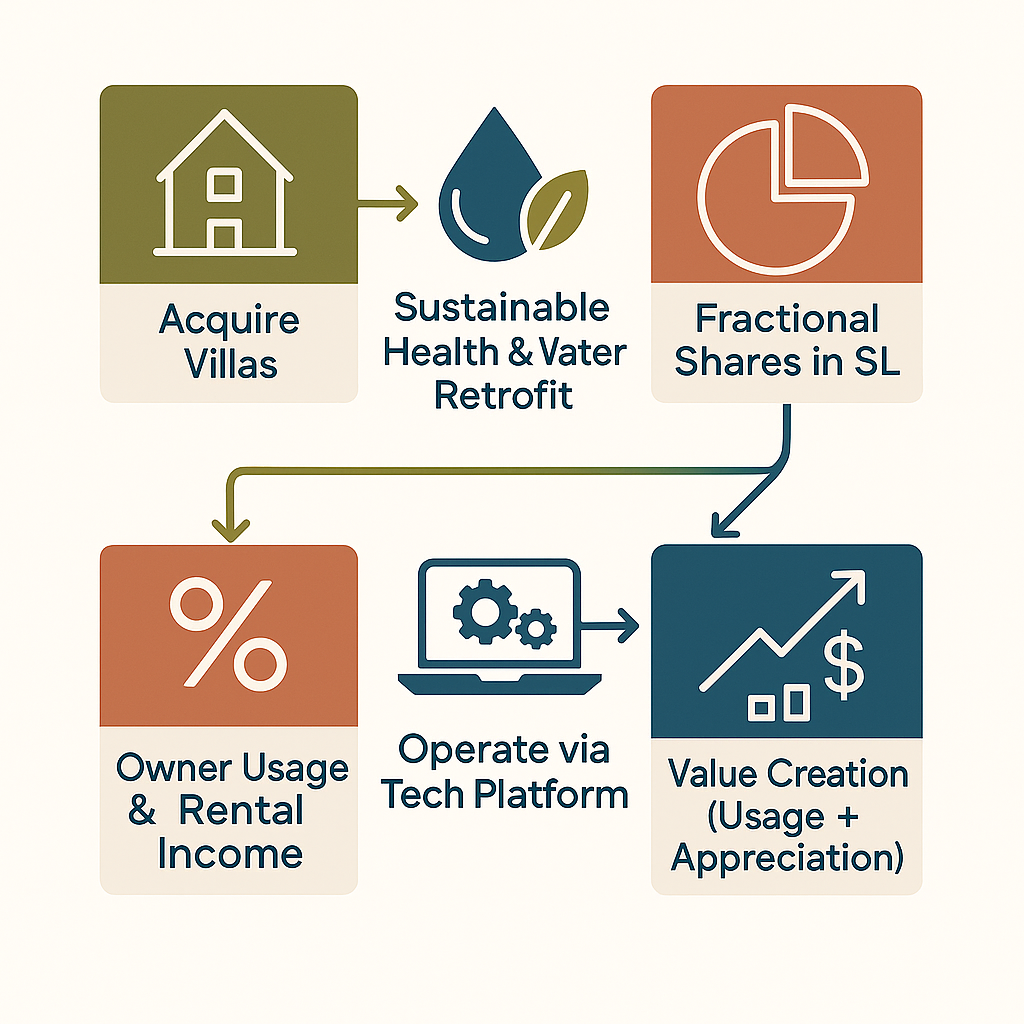

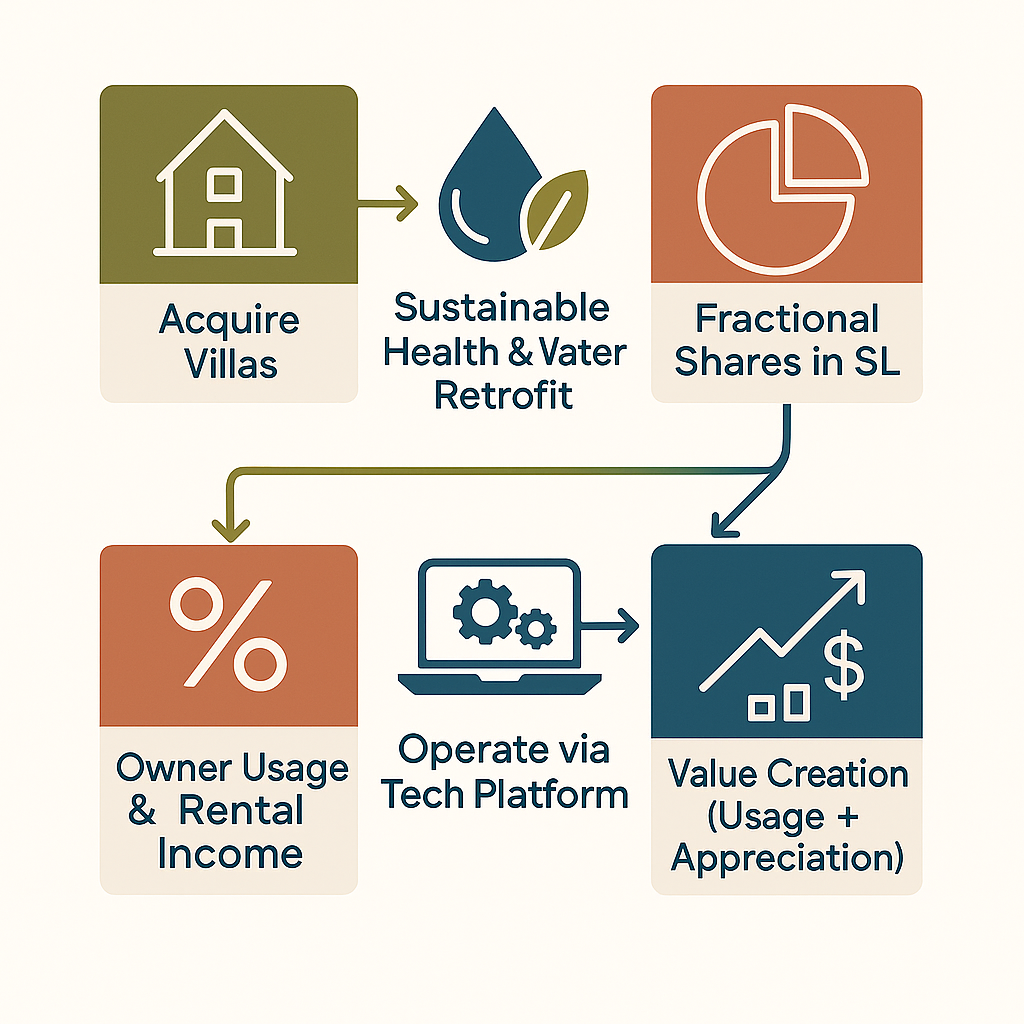

The Model

How Loftly Generates Returns

Acquire > Retrofit > Fractionalize > Operate. We generate revenue through multiple streams with real estate backing.

Seed Investment Opportunity

Join us in building the operating company for wellness-focused fractional villa ownership in Spain. Hard asset-backed returns for sophisticated real estate investors.

The Opportunity

1 Idealista & Casa Rica Estate Market Guide 2025. 2 Costa Blanca tourism board. 3 Alicante (ALC) and Valencia (VLC) airports. 4 Statista 2024, Knight Frank 2024. 5 Global Wellness Institute, "The Global Wellness Economy" 2024.

The Challenge

The Model

Acquire > Retrofit > Fractionalize > Operate. We generate revenue through multiple streams with real estate backing.

Seed Investment

Seed investors own equity in Loftly (the operating company), not individual properties. Here's what you're investing in:

Markup on property fractionalization (~€80k per property)

Of rental income (recurring, portfolio-wide)

Margins on linens, bath, local goods

In-house renovation captures contractor margins

Proprietary scheduling algorithms, booking platform, operational systems

Premium wellness positioning and lifestyle brand assets

Vertically integrated renovation capturing contractor margins

Scalable property management and guest experience software

SAFE Structure: €5M at €15M valuation cap. Converts to equity at Series A (projected Year 3-4 at €12M+ pre-money). This is a capital-intensive real estate business, not a high-growth tech play. Returns depend on execution, market conditions, and scaling trajectory.

The Numbers

Illustrative projections based on 2-3 pilot properties scaling to 18 properties by Year 5.

| Metric | Year 1 | Year 3 | Year 5 |

|---|---|---|---|

| Properties in Portfolio | 2 | 8 | 18 |

| Token-Key Owners | 12 | 48 | 108 |

| Loftly Revenue | €275k | €755k | €1.2M |

| Net Operating Income | ~Break-even | €200-300k | €350-500k |

Note: Projections are illustrative. Full details, assumptions, and sensitivity analysis available in the prospectus. Returns depend heavily on execution, market conditions, and growth trajectory.

Capital Allocation

Capital efficiency: 71% goes directly into revenue-generating assets. This is a real estate investment first.

Liquidity

Seed investors benefit from company-level exits, not individual property sales.

At 15-30 property portfolio scale, raising growth capital at higher valuation

Hospitality brands, lifestyle companies, or PE seeking turnkey wellness platform

White-label our technology and operational model to other markets

Leadership

Led by experienced professionals in real estate, sustainable design, hospitality, and technology.

Chief Design Officer

NYSID graduate with 10 years of hospitality startup experience, specializing in creating wellness-focused, biophilic living spaces that blend luxury with sustainability.

CTO & Founder

Startup veteran with 22 years experience. Founder of SpainExpat.com, the leading resource for expatriates in Spain, with deep knowledge of the Spanish property market and regulatory environment.

Interested in joining our €5M Seed round? Submit your details below and we'll send you the full Investor Prospectus.