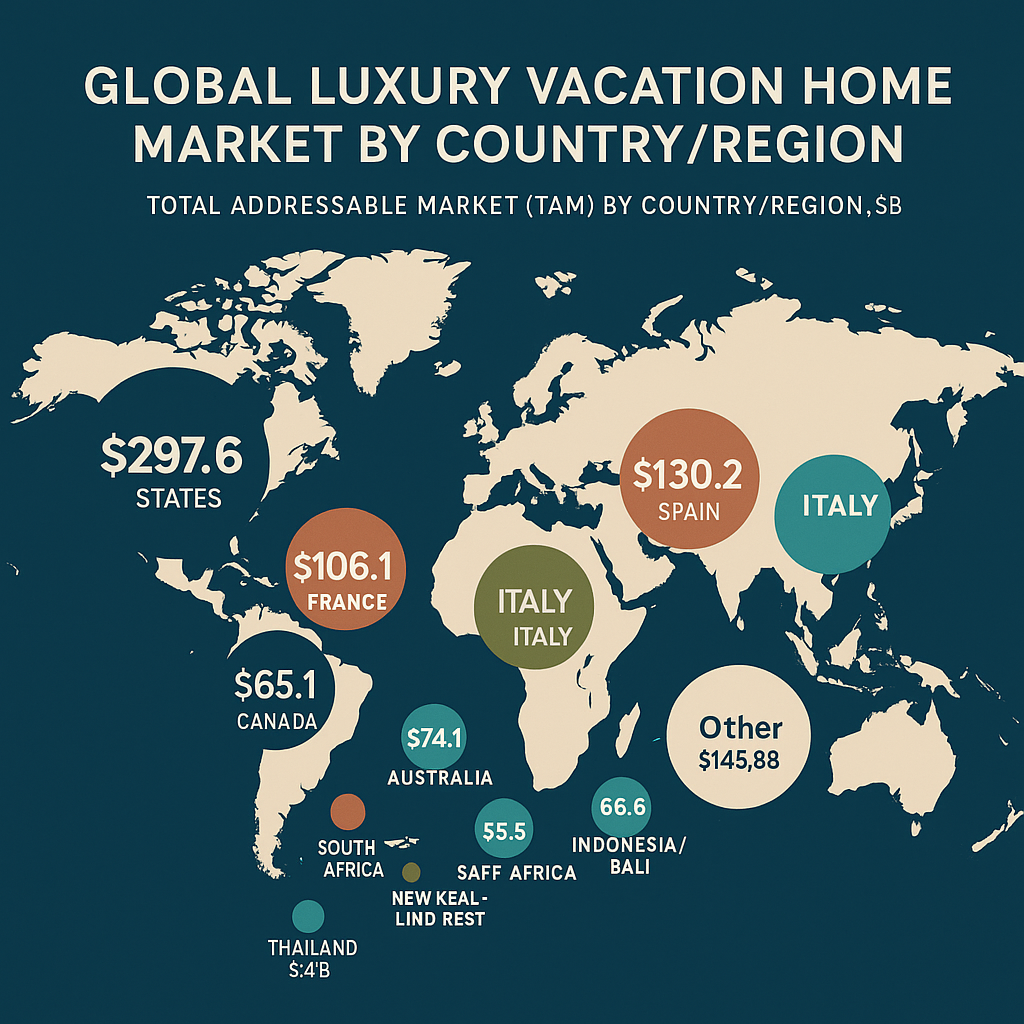

Spain's luxury property market — and the global luxury vacation home market is a $1.8T+ opportunity — offers robust returns driven by strong demand and limited supply in prime coastal destinations. Sustainable features add a further premium and resilience to long-term value.

Market Growth & Appreciation (2025-2026 Update)

The Costa Blanca luxury market has shown exceptional performance, with Alicante province recording 15.9% YoY appreciation (July 2025) (Idealista, Tinsa). The broader Valencian Community saw 18% growth (Casa Rica Estate). While this pace may moderate, forecasts suggest 5-10% annual appreciation will continue in premium coastal locations.

Airbnb & Short-Term Rental Yields

Premium wellness villas in target areas (Calpe, Denia, Altea) achieve strong performance:

- ADR: €500-700/night for premium 4-6 bed sea-view villas (ChicVillas, Villanovo)

- Occupancy: 55-80% annually (higher in peak season)

- Gross Rental Yield: 6-12% depending on location and amenities

- Net Yield: 3-5% after full-service management and operating costs

Return Scenarios

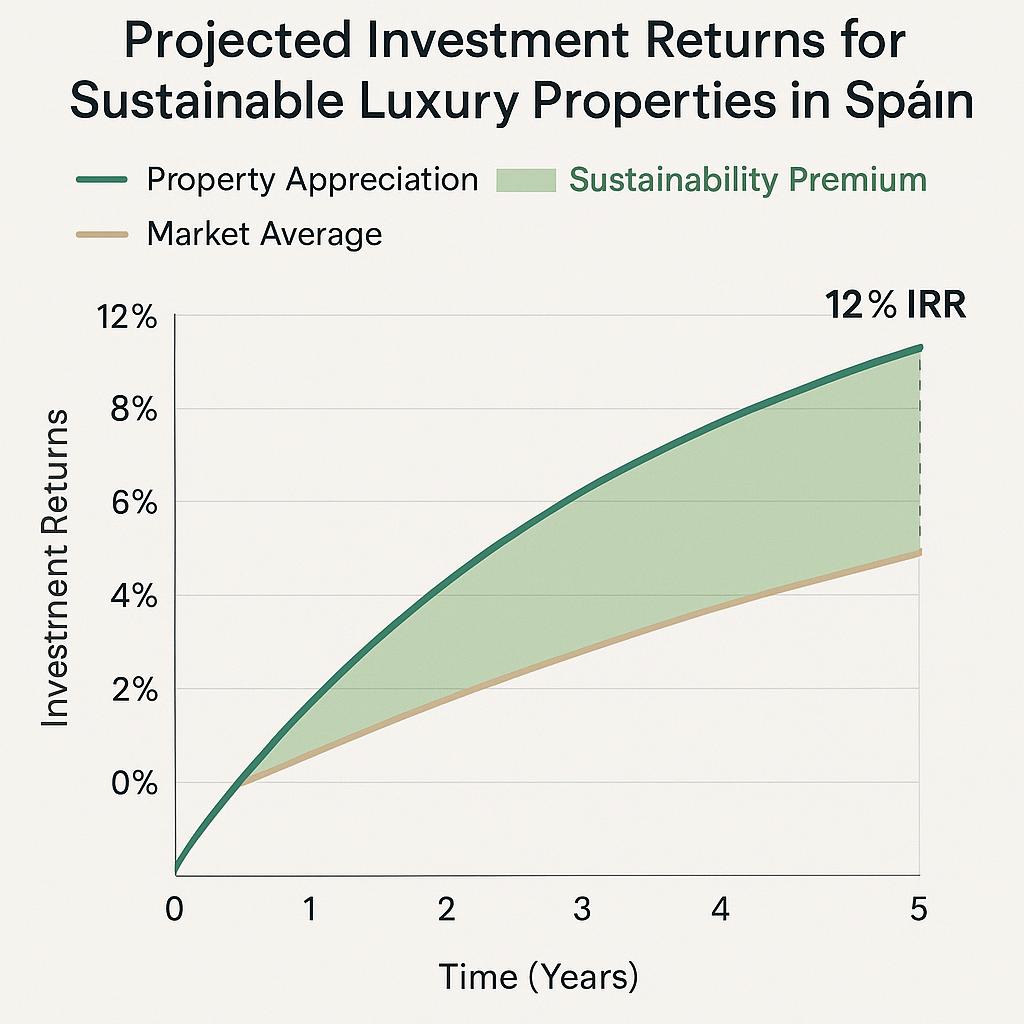

Fractional investments start at €125k–€225k per Token-Key. Based on current market data, projected IRR over a 5-year hold varies by scenario:

| Scenario | Appreciation | Net Yield | Total IRR |

|---|---|---|---|

| Conservative | 2% | 3-4% | 5-6% |

| Base Case | 5-7% | 3-4% | 8-11% |

| Optimistic | 10-12% | 4-5% | 12-15% |

Sustainability Premium

- 5-15% sales premium for eco-certified properties in Spain's luxury market

- 52% of buyers willing to pay more for water-efficient and health-focused design

- Tax incentives up to 60% for energy and water improvements

- Lower operating costs and insurance rates for certified sustainable properties

Combining fractional ownership with sustainable luxury maximizes returns and mitigates risks, making Loftly an attractive proposition for savvy investors.

Data sources: Casa Rica Estate, Investropa, BlancaStay, Spainora (2024-2025). Past performance is not indicative of future results. See our investor page for full assumptions and risk factors.