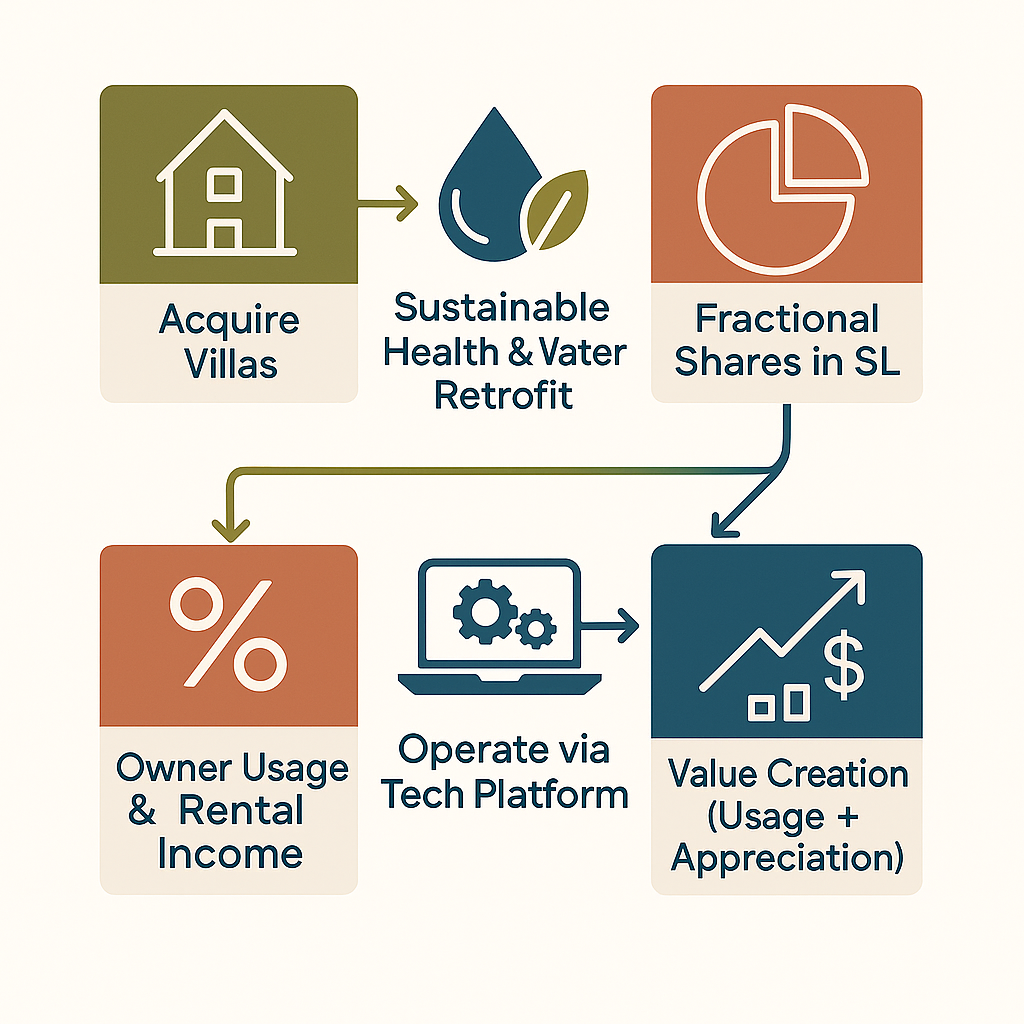

Our Business Model

Acquire > Retrofit > Fractionalize > Operate. We generate revenue through capital appreciation, optimized owner-usage via an SL structure, and potentially future land value realization.

Join us in reshaping the Spanish vacation home market — and beyond — with sustainable, wellness-focused fractional ownership villas targeting 12% IRR.

12%

€5M

We are raising €5M in seed funding to acquire and renovate our initial 3 pilot properties, establishing our unique model in Spain and for future global markets, focused on wellness and water sustainability in prime Spanish locations.

Acquire > Retrofit > Fractionalize > Operate. We generate revenue through capital appreciation, optimized owner-usage via an SL structure, and potentially future land value realization.

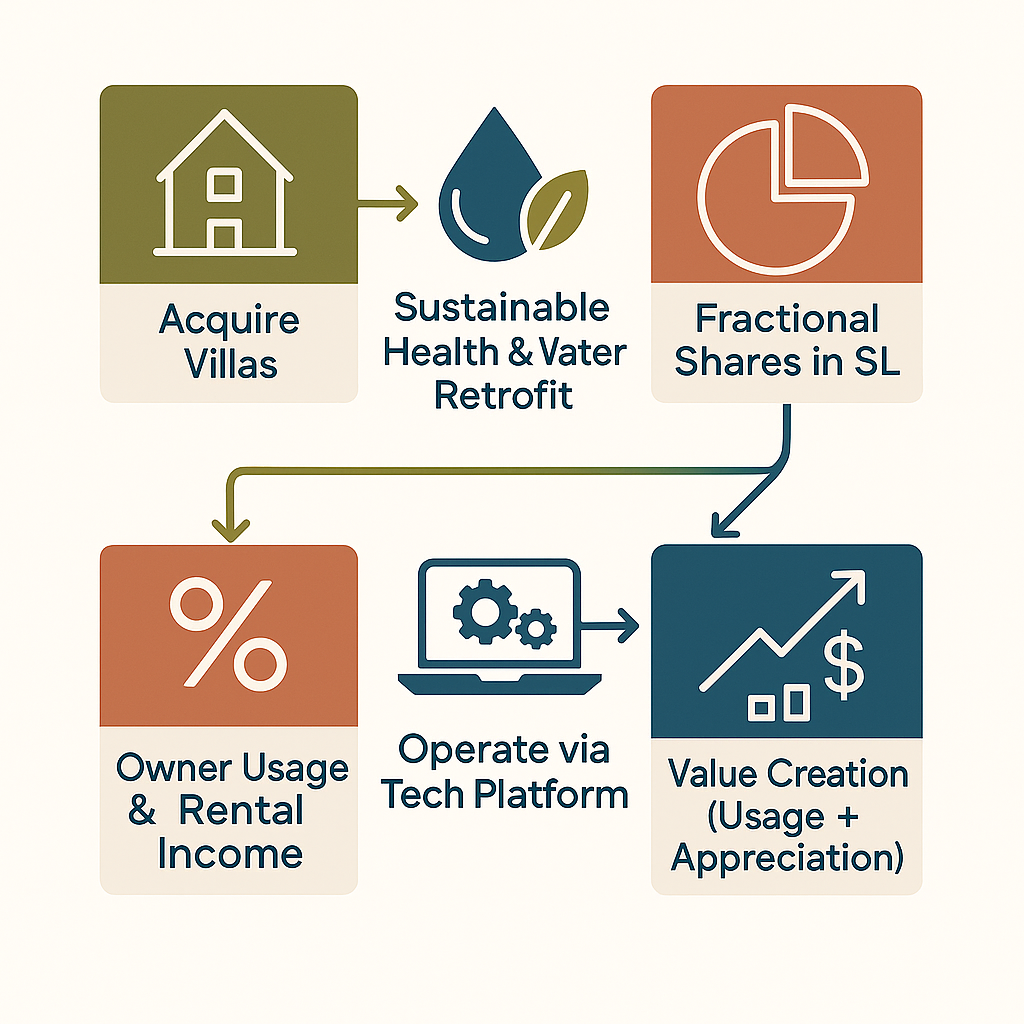

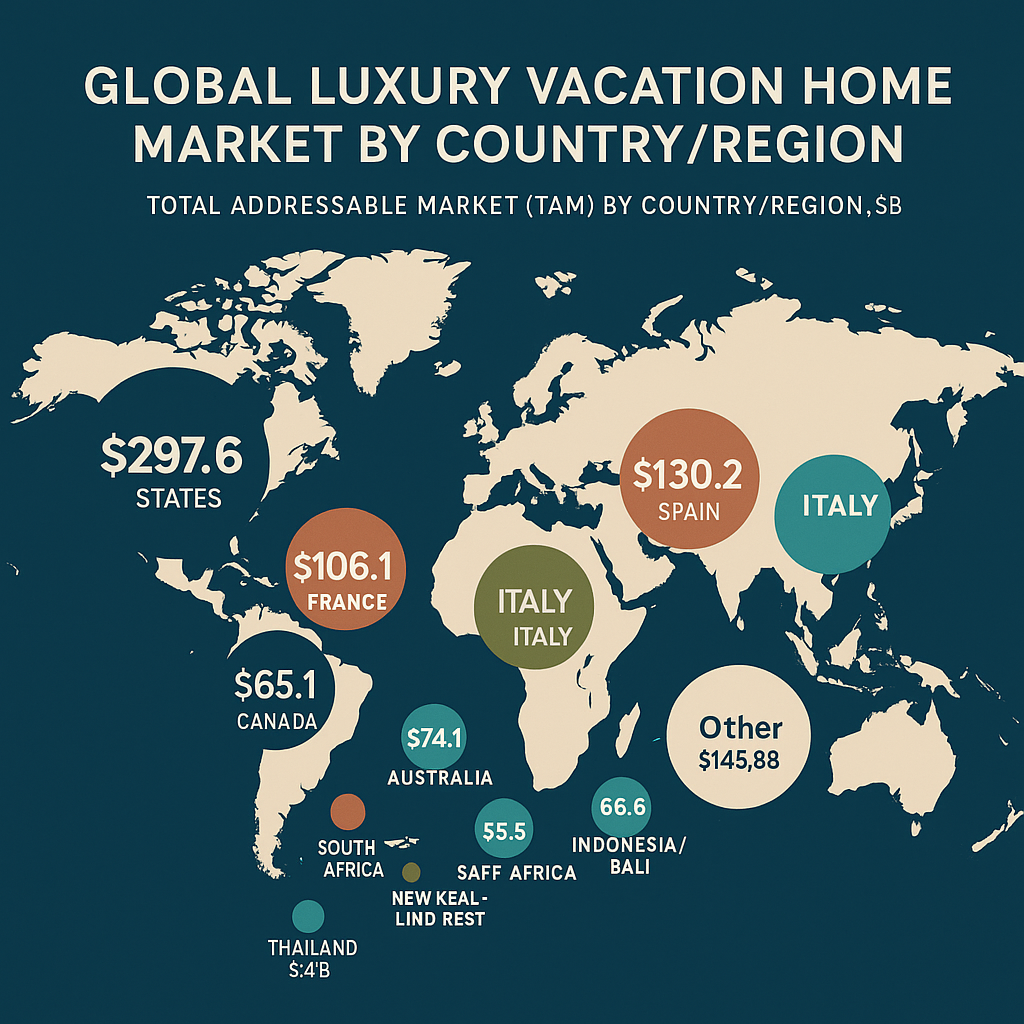

The global luxury vacation home market is estimated at $1.3 trillion in the U.S. and $500 billion in Europe alone. Loftly's scalable, tech-enabled model is designed to capture a share of this vast market as we expand beyond Spain.

Global Luxury Vacation Home Market: $1.8T+

While the global vacation home market presents vast opportunities, the Costa Blanca, Spain, offers a compelling strategic advantage for our initial focus. Its unique combination of high rental demand, strong ROI indicators, and excellent accessibility positions it as an ideal launchpad for Loftly's innovative model. Here’s a snapshot comparing key performance indicators against other popular European investment destinations:

| Region | Typical ADR (USD) | Typical Occupancy | Key Market Insights | Connectivity/Access |

|---|---|---|---|---|

| Costa Blanca, Spain | ~$77 | ~80% (Vacation Rentals) | High year-round demand; WHO-recognized climate; strong international tourism growth (+16.3% YoY); stable, large second-home market. | Excellent: Direct flights (Alicante/Valencia), high-speed rail. |

| Algarve, Portugal | ~$140-270 | ~47-50% (Annual Avg) | Seasonal peaks; some oversupply; popular for beaches/golf. | Good: Faro airport. |

| Tuscany, Italy | ~$120-180 (EUR €110-€164) | ~53% (Regional Avg) | Strong cultural appeal; premium properties; varied sub-regional performance. | Good: Florence/Pisa airports. |

| South of France (PACA) | ~$160-195 | ~54-55% (Annual Avg) | High-end market; strong seasonality; diverse (coastal/alpine). | Excellent: Nice/Marseille airports, TGV. |

| Greek Islands | ~$130-350 (EUR €128-€350) | ~40-75% (Highly Seasonal) | Cyclades premium/high-demand; Crete more budget-friendly; very seasonal. | Variable: Major islands well-connected. |

This data underscores the Costa Blanca's attractive balance of robust occupancy rates and accessible investment levels, reinforcing its selection as Loftly's foundational market for delivering strong investor returns and exceptional owner experiences.

Post-Brexit rules (90/180 day), Spain's recent termination of the Golden Visa program, and tightening STR regulations create significant friction for international buyers. Loftly offers a compliant co-ownership solution focused on the growing demand for sustainable, wellness-oriented properties in Spain.

Our model projects attractive returns based on conservative appreciation, operational efficiencies, and the premium associated with our niche focus.

| Metric | Target |

|---|---|

| Projected IRR (5-Year Hold) | 12% |

Note: Projections are illustrative. Full details, assumptions, and sensitivity analysis available in the investor prospectus.

Funds will be strategically allocated to acquire and renovate pilot properties, develop our platform, and establish operations.

€2.4M

60%

€0.6M

15%

€0.5M

12.5%

€0.25M

6.25%

€0.25M

6.25%

Note: Allocation breakdown based on current prospectus figures (€4M total shown). Please refer to the final prospectus for the confirmed €5M allocation.

We envision exit opportunities for investors via a future secondary market (potentially tokenized) or the sale of the entire property after a planned 5-year hold period.

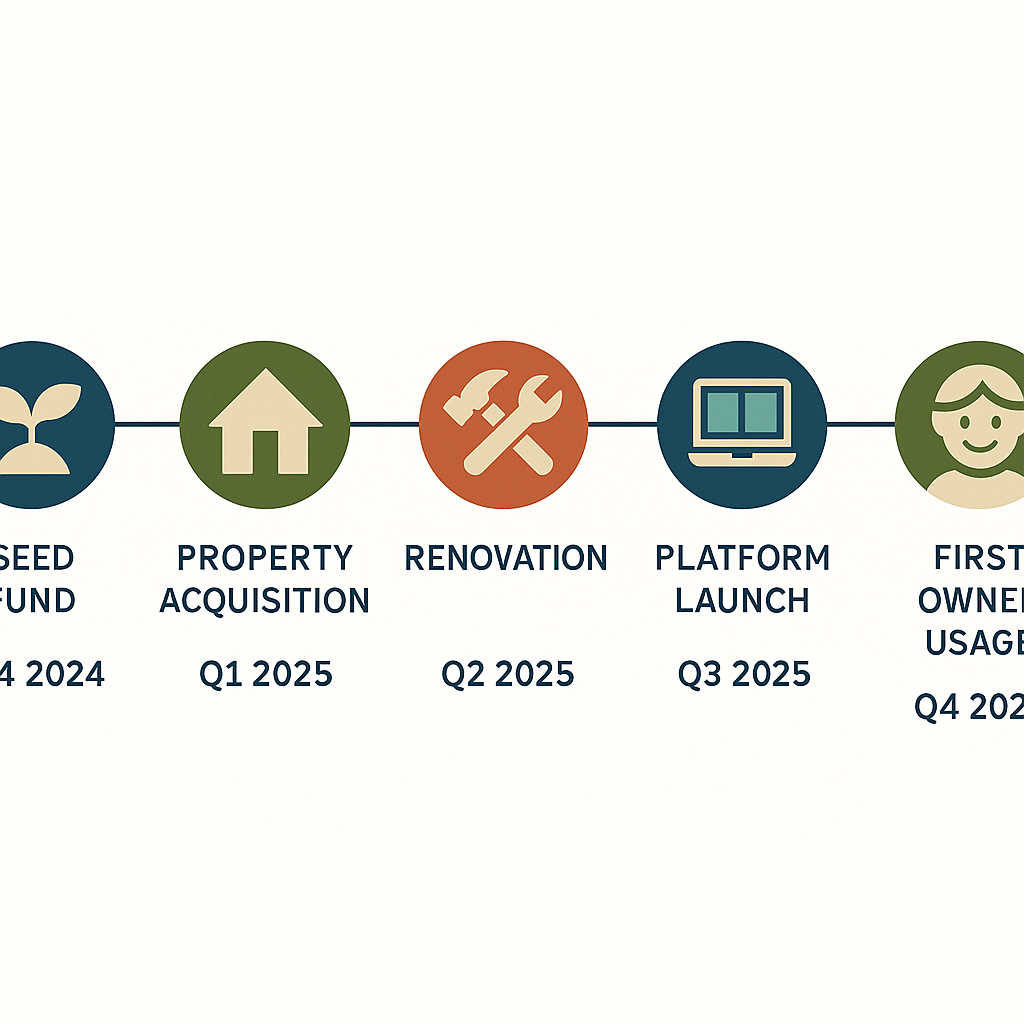

We are executing on our plan to launch Loftly.

Led by experienced professionals in real estate, sustainable design, hospitality, and technology.

Chief Design Officer

NYSID graduate with 10 years of hospitality startup experience, specializing in creating wellness-focused, biophilic living spaces that blend luxury with sustainability.

CTO & Founder

Startup veteran with 22 years experience. Founder of SpainExpat.com, the leading resource for expatriates in Spain, with deep knowledge of the Spanish property market and regulatory environment.

To receive a copy of the full Investor Prospectus, including detailed financials and strategy, please complete the contact form below. We will email it to you promptly. Alternatively, you can download a summary version directly:

Download Prospectus Summary v2.1 (PDF)Interested in joining our Seed round? Please provide your details below. Upon submission, our Investor Relations team will be in touch and email you the Investor Prospectus.