On April 3, 2025, Spain officially ended its Golden Visa program, which since 2013 had granted residency to non‑EU investors purchasing €500k+ in real estate. While 22,430 visas were issued through 2024—including 14,576 real‑estate‑linked visas—this shutdown removes a major €1.1–1.5 billion/year capital inflow for luxury property markets.

Why the Program Ended

Authorities cited a severe housing affordability crisis, limited job‑creation impact, EU concerns over security and money laundering, and public equity demands.

Investor Impact

Non‑EU buyers now face 90‑day Schengen limits, higher financing hurdles, and tighter rental rules—especially given the new national registry and community approval requirements for short‑term rentals effective July 2025.

Loftly’s Fractional Ownership Solution

Optimized Usage

Our 1/8th share model grants 6–7 weeks of annual usage—perfectly aligned with Schengen stays.

Spanish SL Structure

- Clear governance via SL bylaws and shareholder agreements

- Financing advantages via Spanish corporate lending channels

- Simplified inheritance and transfer processes

No Rental Reliance

Co‑owners share costs proportionally, making ownership viable without short‑term rental income.

Lower Investment Threshold

Fractions start at €100k–€150k, reducing capital requirements by 80% compared to Golden Visa properties.

“Fractional ownership is a superior approach for international buyers navigating an evolving regulatory landscape.” — Sarah Johnson, CEO of Loftly

Case Study: UK Investors

John and Emma Thompson swapped a sole €600k Calpe purchase for a 1/6th fraction (€150k) in a €900k villa, gaining 8 weeks of usage, professional management, and shared costs.

Looking Ahead

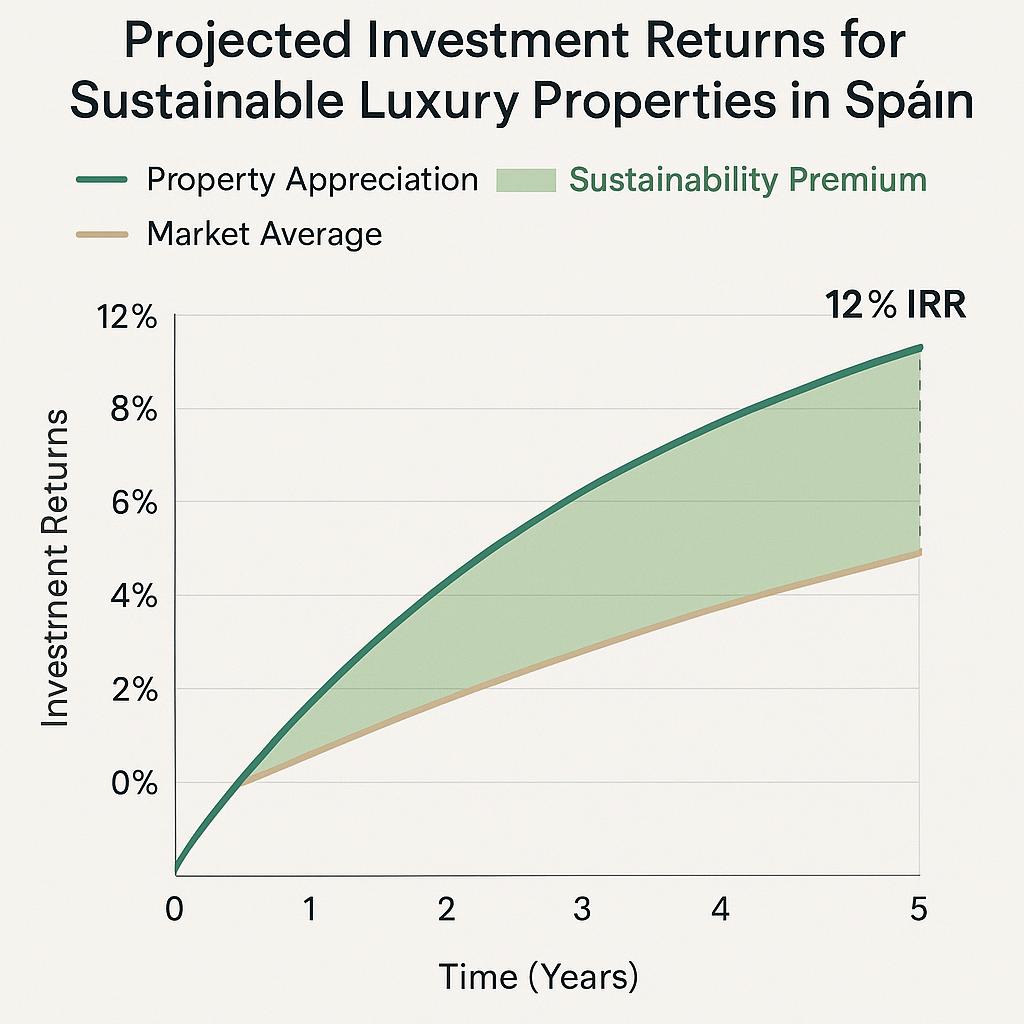

- Spanish property growth projected at 4.5–7% in 2025

- Strong demand persists for Mediterranean lifestyles

- Alternative visas (non‑lucrative, entrepreneur) remain available

Innovative ownership structures like Loftly’s fractional model now align ownership with regulatory realities.

Conclusion

The Golden Visa’s end marks a pivotal shift—but also an opportunity for solutions built for the new era. Discover how Loftly lets you own smartly.

Ready to explore fractional ownership? Contact our team today.